Auctions

Gibbons shifting focus to navigate market turmoil

The renowned British stamp firm of Stanley Gibbons is downplaying the profit warning it issued to shareholders in early April, even as the firm has taken steps in recent months to diversify its business activities and insulate its bottom line from the ups and downs of dealing in high-end stamps.

Shares of Stanley Gibbons, which has a market cap of £129 million (about $190 million), are traded on the London Stock Exchange’s AIM market for small and growing companies. Their value dropped about 10 percent after the April 2 profit warning.

After the British press reported the warning, which the Financial Times called the result of “a ‘perfect storm’ of failed deals,” Gibbons chief executive Mike Hall wrote in an e-mail to Linn’s Stamp News that although the company’s profit for the year ending March 31 would be below expectations, it would still show “significant growth compared to the prior year.”

The storm of disappointment apparently centered around the unconsummated £1 million sale of a coin to an American collector, who failed to pay.

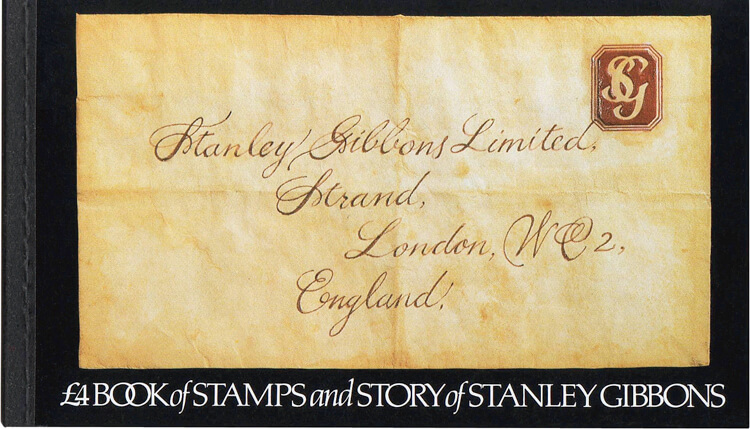

It may surprise American stamp collectors to learn that Gibbons even deals in coins. Many think of the firm, which traces its origins to 1856, when young Edward Stanley Gibbons began selling stamps in a corner of his father’s shop in Plymouth, England, as a philatelic powerhouse.

But during the past two years, the firm has made aggressive acquisitions into other areas, buying up retailers and auctioneers that include Baldwin’s, a numismatic firm with a pedigree to match that of Gibbons, as well as firms dealing in antiques, fine arts and other collectibles.

Hall said the firm might return to high-end stamp sales in New York, where it once had offices conducting stamp auctions and high-end retail sales, since one of its 2014 acquisitions, Mallett Antiques, has an office on Madison Avenue.

Stanley Gibbons is also known to American collectors as the publisher of general and specialized catalogs of the stamps of Great Britain and its former empire.

It is one of just four publishers, along with France’s Yvert & Tellier, Germany’s Michel, and Amos Media, parent company of Linn’s and publisher of the Scott catalogs, that regularly puts out a set of catalogs listing stamps of the entire world.

According to Hall, however, catalog publishing accounts for just 5 percent of Stanley Gibbons’ revenue. Half comes from dealing and auctioning stamps, while 15 percent comes from coins and the rest from other collectibles.

Unlike Yvert, Michel or Scott, Gibbons actively touts stamps as an investment vehicle, highlighting the strong returns achieved by high-end stamps and postal history. A section of the website stanleygibbons.com is devoted to encouraging noncollectors to put their money in stamps, with slick downloadable prospectuses, video pitches and extensive background information comparing stamps favorably to other investments.

Yvert retails stamps, but does not offer them as an investment; Michel and Scott are strictly publishers.

Asked about the obvious potential for conflict of interest when an arbiter of catalog pricing also bases part of its business on hoping for a dependable rise in prices, Hall took pains to point out that Gibbons does not guarantee returns.

Prices in the catalog are set by a staff in London, he said, with a “reputational interest as respected specialists in their fields to report prices with integrity,” based on third-party auction results.

Meanwhile, the investment arm is managed in the Channel Islands and subject to annual audits by an independent stamp expert, Hall said.

Hall said that within three years, the share of firm revenues coming from high-end stamp dealing should drop to around 10 percent as a result of diversification, including growth in worldwide collectibles auctions and commissions from its online marketplace.

Gibbons is placing high hopes on its online marketplace for stamps, coins and collectibles, which has grown out of its 2009 acquisition of bidStart, a website similar to eBay that was originally called StampWants.

Readers may remember StampWants as the firm that gave away an Inverted Jenny, the famous U.S. airmail error stamp (Scott C3a), in a promotional stunt in 2008. The site has since flourished as it gained a reputation for being a more seller-friendly alternative to eBay.

A relaunch under the Stanley Gibbons brand name has been delayed while the firm addressed technical issues, and is now expected in May.

Third-party sellers, who typically pay an 8 percent fee, compared to eBay’s 10 percent, do not have to use the Stanley Gibbons catalog numbering system when they list their stamps. In fact, a recent search for a random handful of Victorian-era British stamps returned results listed almost entirely by Scott number.

More from Linns.com:

Kudos to U.S. Postal Service for its decision not to reissue Maya Angelou forever stamp

Special Olympics stamp marks upcoming Los Angeles Games

Penner wants U.S. stamp program to have impact

U.S. Postal Service reveals World Stamp Show stamp design

Great Britain Philately: Paying tribute to the world's first adhesive postage stamp

Keep up with all of Linns.com's news and insights by signing up for our free eNewsletters, liking us on Facebook, and following us on Twitter. We're also on Instagram!

MORE RELATED ARTICLES

Headlines

-

US Stamps

Oct 7, 2024, 3 PMMcMurtrie dismissed as APS education director following Sept. 21 arrest

-

US Stamps

Oct 7, 2024, 12 PMVasiliauskas named president of Mystic Stamp Co.

-

US Stamps

Oct 6, 2024, 5 PMApgar souvenir card available

-

US Stamps

Oct 6, 2024, 4 PMFirst Continental Congress and U.N. stamps receive Scott catalog numbers